35+ Minimum payment on 5000 credit card

Your monthly payment will decrease as your balance is paid down. The minimum payment on a 3000 credit card balance is at least 30 plus any fees interest and past-due amounts if applicable.

Image 042 Jpg

To see the impact of paying off a credit card with minimum payments only consider a credit card balance of 5000 at the current average APR of 2028 as of June 2021 and minimum payment as 2 of your credit card balance.

. While the minimum credit line may be 5000 a much higher limit is not unusual. For customers who have a CareCredit card simply enter the amount youd like to finance to calculate your monthly payment. Missing payments or making late payments may have a negative impact on your credit score.

According to these calculations if you have a total credit card balance of 3000 an interest rate of 2 and the monthly payment is 60 your minimum payment would be 60 per month. Weve found cards that help save you money. What is the minimum payment on a 15000 credit card.

If you only make your minimum payments it will be almost 35 years before youve fully paid off your card. Ad Looking for a great balance transfer card for high-interest debt. Monthly interest payment 000041 450 30 554.

Youve borrowed 2000 on a credit card and the card has a 25 minimum monthly payment. The Monthly Payment shown may be greater than the required minimum monthly payment that will be on your billing. Making minimum payments only it would take you over 30 years and a total of 23399 to pay off that initial 5000.

One other caveat. Check out our top-reviewed credit cards. Your minimum payment is calculated as a small percentage of your total credit card balance or at fixed dollar value whichever is greater.

Ad Credit Cards with 0 Interest Until 2024. If youve exceeded your credit limit your issuer may add that to your minimum payment. Which includes missed or late payments makes up 35 of.

On the other hand if you owe less money youll probably be charged a flat fee around 20. If you were late making a payment for the previous billing period the credit card company may also add a late fee on top of your standard minimum payment. You usually have to pay 2 and 4 of the balance each month on credit cards with a flat percentage minimum payment.

How to Find Out How Yours Is Calculated. Ad Low Interest 2022 Top Lenders Bad Credit Bank Loans Comparison Reviews. Get 0 Intro APR up to 21 Months Enjoy Interest Free Payments until 2024.

The interest rate or APR is 25. Your monthly payment is calculated as the percent of your current outstanding balance you entered. For example if your balance is 1050 and your credit limit is 1000 your minimum payment may be 2 of the balance21plus the 50 from being over the limit for a total of 71.

If you were late making a payment for the previous billing period the credit card company may also add a late fee on top of your standard minimum payment. Credit Card payments are typically setup to deduct the minimum monthly repayment this will normally be calculated as a percentage of the outstanding balance. If your credit card balance is 1000 or more your minimum payment will likely be around 2 of your total balance.

A minimum payment of 3 a month on 15000 worth of debt means 227 months almost 19 years of payments starting at 450 a month. Chase Sapphire Reserve at Chases secure website BEST OVERALL RATING 47 OVERALL RATING 4750 Our Review Earn 60000 bonus points after you spend 4000 on purchases in the first 3 months from account opening. Compare the Best Card Offers Now.

Youll pay more than 5000 in interest overall. The minimum payment on a credit card is the lowest amount you must pay to avoid paying late charges and damaging your credit score. This can greatly increase the length of time it takes to pay off your credit cards.

For credit cards this is calculated as your minimum payment. There are several other ways in which credit card issuers calculate the monthly interest payment including the previous balance method and the adjusted balance method though they arent used all that often. The minimum payment on a 5000 credit card balance is at least 50 plus any fees interest and past-due amounts if applicable.

This is your initial monthly payment. The below example is for credit card with an outstanding balance of 5000 with a minimum repayment of 3 or 5 whichever is higher. The minimum payment due for your credit card bill is usually based on a certain percentage of your account balance.

Setting up yet or email alerts or checking your credit card statement regularly are effective ways to manage your credit card payments. 5000 x 3 150 or 5 if higher. Learn more about CareCredit healthcare credit card payments with the Payment Calculator from CareCredit.

Jons interest payment for the month of June is 554.

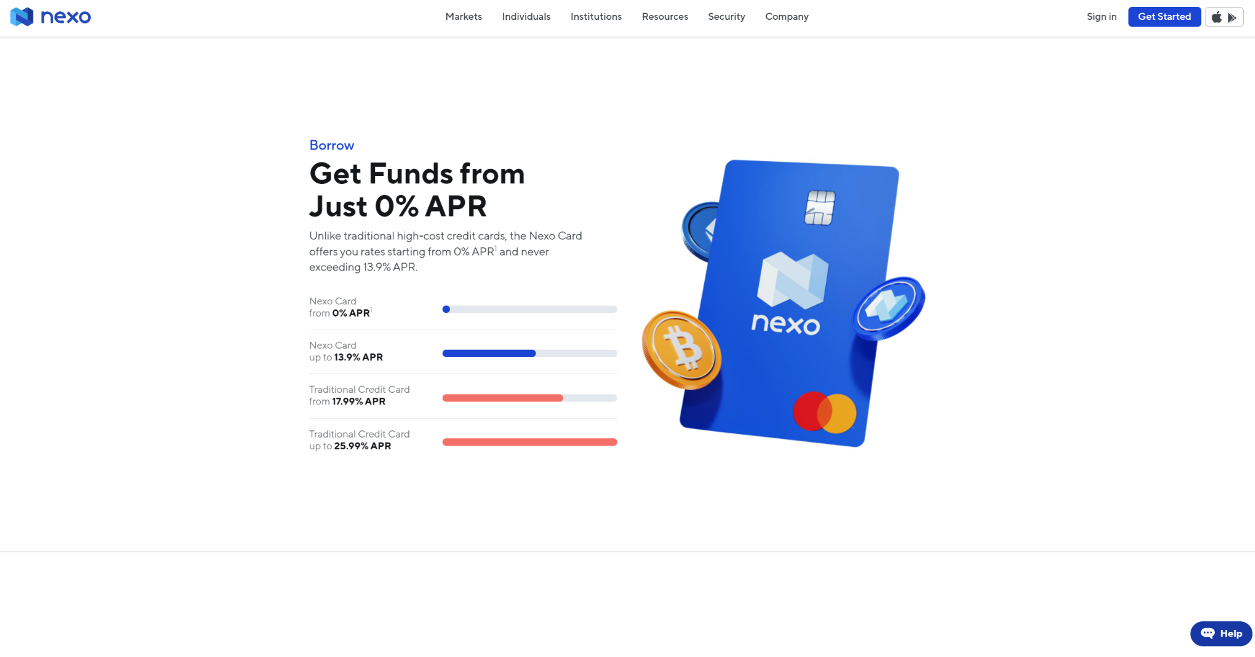

Nexo Card Review 2022 Features Fees Pros Cons Marketplace Fairness

How To Buy Credit Cards Online That Have Money On Them Quora

Nexo Card Review 2022 Features Fees Pros Cons Marketplace Fairness

Image 007 Jpg

Nexo Card Review 2022 Features Fees Pros Cons Marketplace Fairness

Nexo Card Review 2022 Features Fees Pros Cons Marketplace Fairness

American Express Membership Rewards Credit Card Mrcc Bachatkhata Com

Hdfc Bank Infinia Credit Card Review Cardexpert

Nexo Card Review 2022 Features Fees Pros Cons Marketplace Fairness

Sales Commission Contract Template Elegant Sales Agreement Template Real Estate Purchase Agreem Contract Template Business Resume Template Resume Template Word

Nexo Card Review 2022 Features Fees Pros Cons Marketplace Fairness

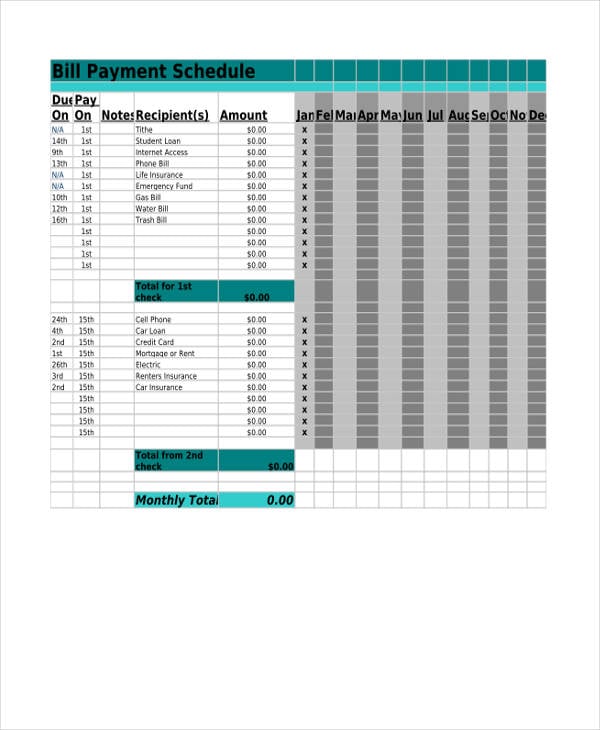

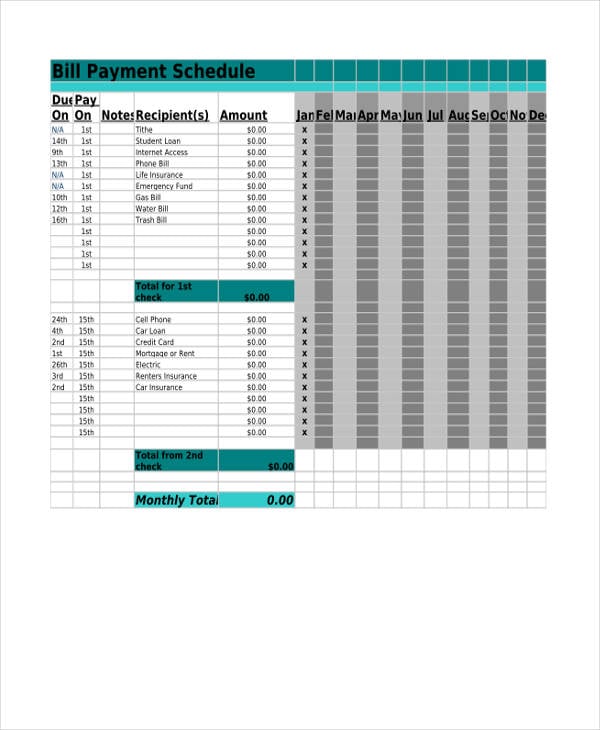

35 Free Schedule Templates Free Premium Templates

How To Add Money To A Chime Card From My Credit Card Quora

Best Credit Card Casino Sites Payment Method Explained

Image 010 Jpg

How To Buy Credit Cards Online That Have Money On Them Quora

Greece 7 Best Prepaid Sim Cards Buying Guide 2022 Phone Travel Wiz